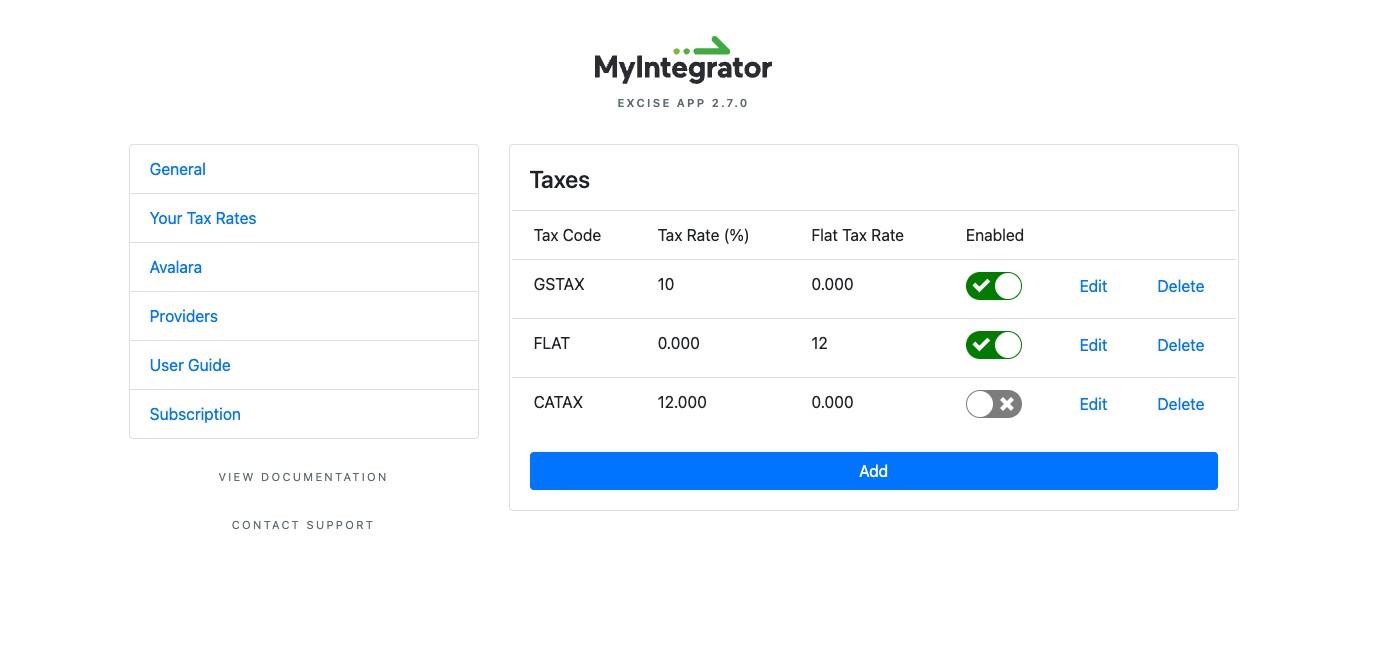

The Taxes section allows you to create and manage custom tax rules that apply to orders based on various criteria. Each tax rule can combine a percentage rate, flat fee, and custom multiplier to calculate taxes for products, shipping, and handling.

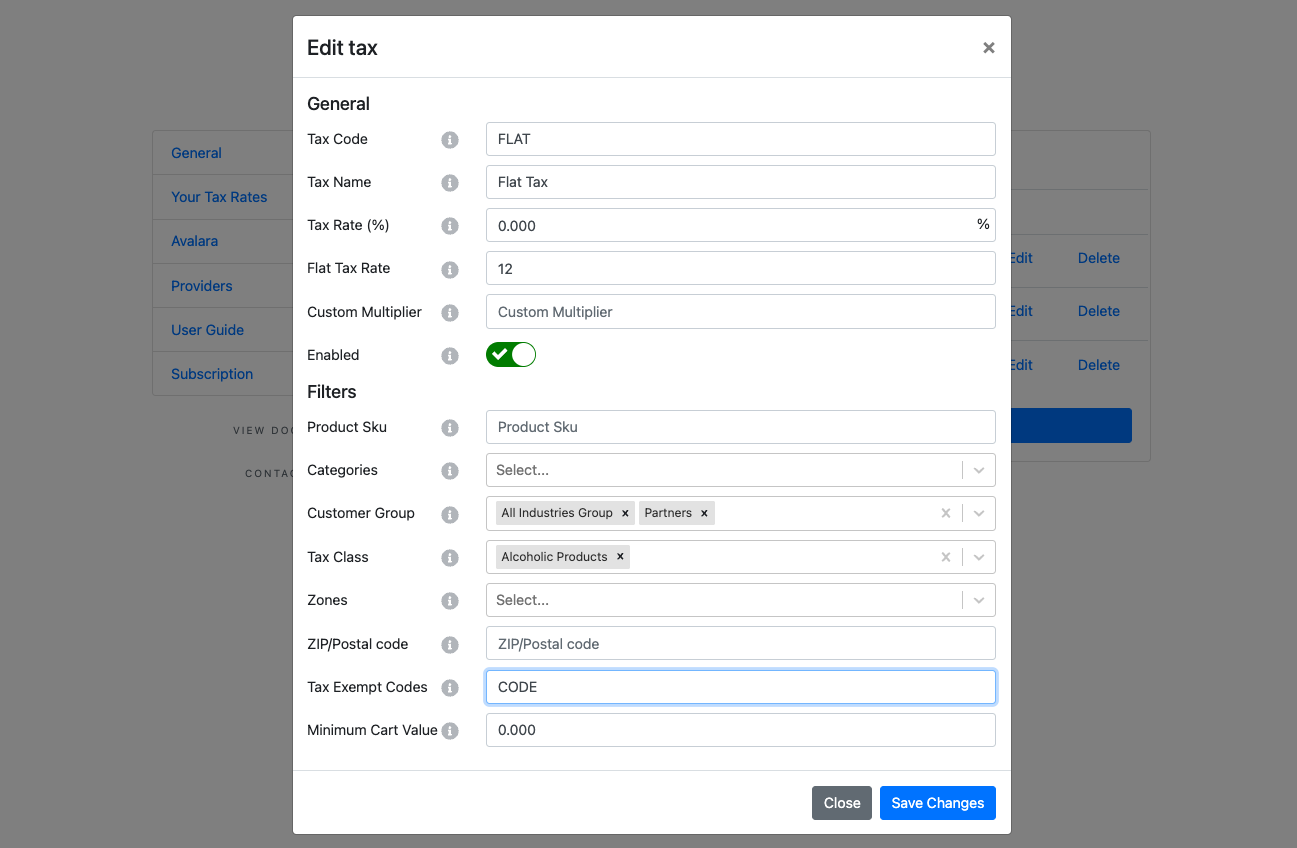

Quick Start: Click the 'Add' button to create a new tax rule, or click 'Edit' on an existing rule to modify it. The configuration modal will open with all available options organised into General settings and Filters.

Important: All filter fields are optional. If a field is left blank, it has no effect and the tax will apply regardless of that criteria. Only fields with values will restrict when the tax applies.

How Taxes Are Calculated

When multiple tax calculation methods are used together, they are combined as follows:

• Percentage Tax: Applied to the item's tax-exclusive price (or calculated from tax-inclusive price if applicable)

• Flat Tax: Multiplied by the quantity of eligible products and added to the total

• Custom Multiplier: (Multiplier × MI_TAX_VALUE) × Quantity, added to the total

(MI_TAX_VALUE is a product-level custom field that can be added to your products via BigCommerce settings)

Example Calculation: For a $100 product with 10% percentage tax, $5 flat tax, and custom multiplier of 0.02 with MI_TAX_VALUE of 50:

• Percentage: $100 × 10% = $10.00

• Flat: $5.00 × 1 quantity = $5.00

• Multiplier: (0.02 × 50) × 1 = $1.00

• Total Tax: $16.00

Multiple Rules: If multiple tax rules match an item, all applicable taxes are added together. Taxes with the same Tax Name are aggregated and displayed as a single line item in checkout.

Note that if 'Include BigCommerce Basic Taxes' is enabled, the app's taxes will be returned in addition to the taxes set up in your store's BigCommerce settings. In the event of a collision between the two types of taxes (e.g. BigCommerce returns a 10% rate called 'State Tax', and the MyIntegrator app returns a 12% rate called 'State Tax', only the MyIntegrator tax rate will be returned).

| Setting | Description |

| Tax Code |

Identification tax code for this tax. |

| Tax Name |

Name for this tax (displayed to the user). Tax names are case-sensitive. Please note that if two taxes share a name, they will be aggregated together in the order lines. If "Use BigCommerce Fallback Tax" is enabled and this name exactly matches a BigCommerce Basic Tax rate name, your app tax will override the BigCommerce rate whenever it applies. |

| Tax Rate (%) |

Tax rate to charge customers, calculated as a percentage of the order total cost. It can be set to zero in order to serve as a tax exemption. |

| Flat Tax Rate |

A flat tax value, which will be multiplied by the number of eligible products and added to the customer's tax total.

Eligible products are the ones that trigger the tax rule, i.e. a product SKU held in the below 'Product SKU' field. Only product quantities will be used to determine flat taxes, not shipping or handling. |

| Custom Multiplier |

Enter a multiplier value (tax rate) that will be multiplied by the value stored in a product's 'MI_TAX_VALUE' custom field. The calculation is: (Multiplier × MI_TAX_VALUE) × Quantity = Tax Amount. This is useful for variable tax rates based on product-specific values (e.g., weight-based taxes, volume-based excise, or custom duty calculations). If a product does not have the 'MI_TAX_VALUE' custom field, it will not receive this tax at all. The custom field must be added manually via your store's BigCommerce settings. |

| Enabled |

Toggle this switch on or off to enable or disable the tax rate. |

| Product SKU |

A comma-separated list of product SKUs that will receive this rate. Only orders containing these products will have the tax rate apply to them. |

| Categories |

Select the set of product categories that will receive this rate. Only orders containing products in these categories will have the tax rate apply to them. |

| Customer Groups |

Select the set of customer groups that will receive this rate. Only orders belonging to customers in these groups will have the tax rate apply to them. |

| Tax Class |

Select the set of tax classes that will receive this rate. Only orders containing products belonging to these tax classes will have the tax rate apply to them. |

| Zones |

Select the set of shipping zones that will receive this rate. Only orders within one of these shipping zones will have the tax rate apply to them. |

| ZIP/Postal Code |

Enter a comma-separated list of ZIP(Postal) codes that can receive this tax rate. |

| Tax Exempt Code |

Limit the tax to apply only to customers with specific tax exempt codes. Enter as a comma-separated list (e.g., "G,A,L" where G=Wholesale, A=Government, L=Other). If left empty, the tax applies to all customers regardless of their exemption status. Tax exempt codes must be set on individual customer accounts in BigCommerce (Customers > [Customer] > Tax Exempt Category). |

| Minimum Cart Value |

Set the minimum value of a cart for it to be eligible for this tax rate. This will default to zero (i.e. the rate will apply to orders of any value), and it cannot be negative. |

Common Use Cases

Location-Specific Excise Taxes

Goal: Apply an 11% excise tax only to alcohol products shipped to California.

Setup:

1. Tax Rate = 11% (or your excise rate)

2. Tax Name = "CA Excise Tax"

3. Category = Select "Alcohol" category

4. Zone = Select "United States: California"

Result: Only alcohol products shipped to California receive the 11% excise tax. Alcohol shipped elsewhere receives no excise tax from this rule.

Product Category-Based Duties

Goal: Charge $25 import duty per imported product.

Setup:

1. Tax Rate = 0%

2. Flat Tax Rate = $25.00

3. Tax Name = "Import Duty"

4. Category = Select "Imported Goods" category

5. Optionally add Zone filter for specific countries

Result: Each imported product in the order incurs a $25 duty. An order with 3 imported products = $75 total duty. Important: Flat taxes only apply to products, not to shipping or handling charges. Only percentage taxes apply to shipping and handling.

Overriding BigCommerce Basic Taxes

Goal: Use BigCommerce's standard tax rates, but override them for specific products or customer groups.

Setup:

1. Enable "Use BigCommerce Fallback Tax" in General Settings

2. Check your BigCommerce tax rate names (e.g., "GST included", "Sales Tax")

3. Create an app tax rule with Tax Name exactly matching a BigCommerce rate name (case-sensitive)

4. Set your desired Tax Rate and add filters (e.g., Tax Exempt Code="G")

Result: Tax Exempt customers see your custom rate. All other orders use BigCommerce's standard rates as fallback. The app tax with the matching name takes precedence over the BigCommerce rate for orders that match your filters.

Weight-Based Tax Using Custom Multiplier

Goal: Charge tax based on product weight (e.g., $0.50 per pound).

Setup:

1. Add 'MI_TAX_VALUE' custom field to products in BigCommerce with weight as the value (e.g., 5 for 5 pounds) - Products > [Product] > Custom Fields

2. Create tax rule with Custom Multiplier = 0.50

3. Tax Name = "Weight Tax"

4. Add filters as needed (Category, Zone, etc.)

Result: A 5-pound product (MI_TAX_VALUE=5) with quantity 2 = (0.50 × 5) × 2 = $5.00 tax. Note: If a product doesn't have the MI_TAX_VALUE custom field, it will not receive this tax. The multiplier calculation only applies to products, not shipping or handling.

Tax-on-Tax Using BigCommerce Basic Taxes

Goal: Apply excise tax first, then calculate sales tax on top of the excise-inclusive price (true tax-on-tax).

Setup:

1. Enable "Use BigCommerce Fallback Tax" in General Settings

2. Enable "Apply Duties on Top" in General Settings

3. In BigCommerce, configure a "Sales Tax" rate at 8.5% for your zone

4. Create an app tax rule with Tax Name = "Excise Tax" (different name from BigCommerce rate)

5. Set Tax Rate = 11% for excise tax

6. Add filters (e.g., Category="Alcohol", Zone="France : Paris")

Result: For a $100 product:

• Step 1: App applies Excise Tax (11%) = $11.00

• Step 2: BigCommerce applies Sales Tax (8.5%) on the tax-inclusive amount ($111.00) = $9.44

• Total tax = $20.44 (Excise $11.00 + Sales Tax $9.44)

• Final price = $120.44

How it works: When "Apply Duties on Top" is enabled, BigCommerce Basic Taxes are calculated on the tax-inclusive price (after app taxes). This creates true tax-on-tax where the second tax is calculated on top of the first. Both taxes appear as separate line items in checkout. Note: If you want both taxes calculated on the base price instead, disable "Apply Duties on Top"—both will then calculate on the tax-exclusive amount.

Combining Multiple Tax Types

Goal: Apply both percentage and flat taxes to the same products.

Setup:

1. Tax Rate = 8.5%

2. Flat Tax Rate = $5.00

3. Tax Name = "Sales Tax + Fee"

4. Add filters as needed (Category, Zone, etc.)

Result: For a $100 product with quantity 1: Percentage tax = $8.50, Flat tax = $5.00, Total tax = $13.50. Both taxes are combined into a single tax line item. Note: For tax-inclusive pricing, the app calculates the tax-exclusive base price first, then applies both percentage and flat taxes.